ATV Insurance

(To keep you tackling all kinds of terrain)

For some, the freedom of jetting down trails on a four-wheeler with wind in their face and bugs in their teeth is as close as it gets to cloud 9. But an all-terrain paradise isn’t all sweet jumps and epic mud baths. In fact, the road less traveled also comes with a fair amount of risk.

Finding top coverage for your ATV is a trip no rider should go alone. Our independent agents will be there to guide you through a handpicked selection of options to make sure you and your machine are properly protected.

Is ATV Insurance Required?

Maybe. Every state has different minimum requirements, which can make it confusing. In New York, you are not allowed to leave your property without coverage that includes death, bodily injury and property damage liability coverage.

Needless to say, but we will anyway, it’s important to talk to your agent to make sure you are properly and legally covered in your state.

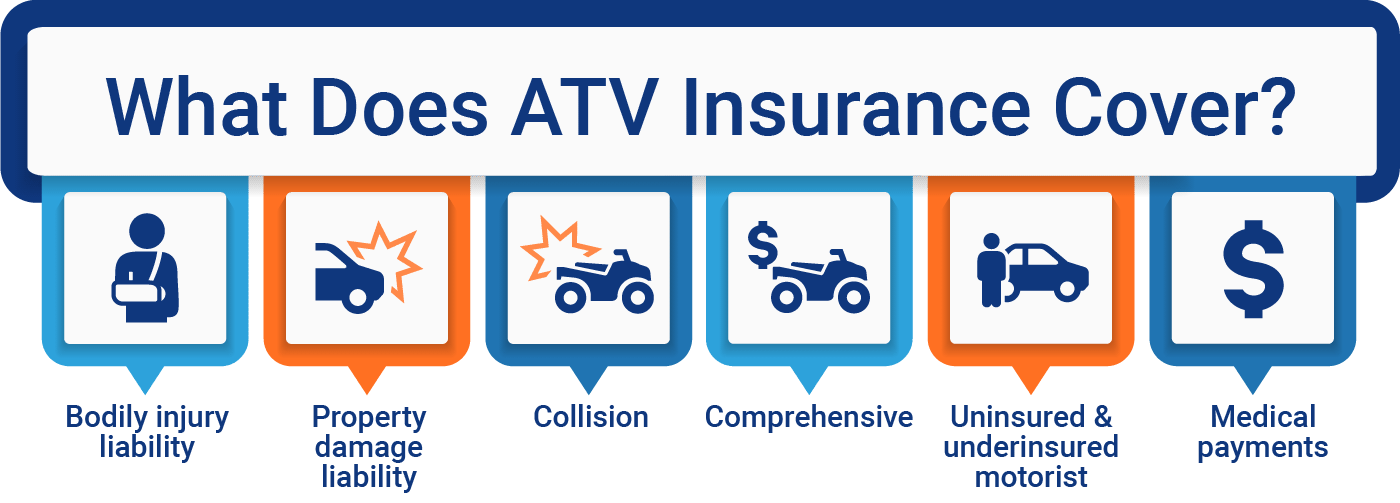

What Does ATV Insurance Cover?

ATV insurance provides the coverage you need specifically for off-roading. Your policy helps protect you financially from damage or injuries related to an ATV accident. Many people think their homeowners or auto insurance policy provides coverage, but this is usually not the case.

Coverage can include the following:

- Collision insurance: Pays for structural damage to your vehicle if you hit another ATV, a rock, a stump, a tree or another object that causes significant damage.

- Comprehensive insurance: Pays damages that result from lightning, vandalism, animals, theft, etc.

- Bodily injury/Property damage coverage: Covers damage and legal defense if you cause an accident that harms another person or their property.

- Uninsured/Underinsured motorist coverage: This optional insurance helps if you or your property are harmed by someone who isn’t properly covered to pay for the losses and damage.

How Much Does ATV Insurance Cost?

Insurance rates for ATVs and UTVs can range from a few hundred bucks to over a thousand per year. It depends on coverage, state requirements and a few other fun little factors, like these:

- How’s your driving? Drivers with a number of traffic violations and accidents are often considered a higher risk and may pay higher rates.

- What do you ride? The make, model and engine of your ATV, and whether it is classified as an on-road or off-road vehicle, will affect your ATV insurance cost.

- How much do you ride? Ride time makes a difference. You’re less likely to encounter as many risks if you only travel by ATV occasionally vs. using it to herd cattle daily.

- Who’s riding? Some companies have age restrictions on ATV and UTV riders, and some will increase premiums if younger drivers will be using the vehicle.

- How do you ride it? If you use your ATV for a work commute, your premium will be different from a rider who uses it for off-roading and gnarly jumps.

The Benefits of Bundling ATV Insurance

You like easy, right? And saving money, you’re cool with that? When you combine your home, auto or even umbrella policies with your ATV policy, you simplify the claim process and can get a nice little discount on your premiums.

Plus, your agent will be able to find any gaps in your protection and eliminate any unnecessary coverage, so you know you’re secure in all the right places.

Finding and Comparing ATV Insurance Quotes

Our agents will review your needs and help you evaluate the ATV coverage that makes the most sense. They’ll also compare insurance policies and quotes from multiple carriers to make sure you have the right protection in place.

Why Go with An Independent Agent?

Independent agents will walk you through a handpicked selection of policies from all the top ATV insurance carriers. Not only that, they’ll cut the jargon and clarify the fine print, so you know exactly what you’re getting.

Most importantly, they’ll be there to help you file a claim. The outcome of insurance claims can be strongly impacted by how the process is approached and handled.

TrustedChoice.com Article | Reviewed by Paul Martin

©2023, Consumer Agent Portal, LLC. All rights reserved.