Florist Insurance

Because even flower shops need protection from hazards

Owners of successful flower shop businesses are responsible for much more than just overseeing the production of visually pleasing floral arrangements. Flower shop owners face several of the same hazards as many other business owners on a daily basis, from natural disasters to theft and beyond.

Fortunately an independent insurance agent can get your flower shop equipped with the right protection under florist insurance. But first, here’s a breakdown of florist insurance.

Flower Shop Stats

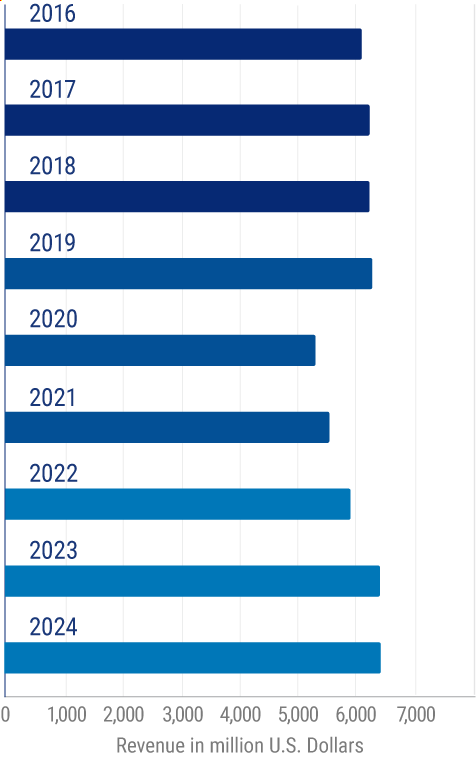

Industry revenue of “florists“ in the US (in million US Dollars)

In the next few years, industry revenue of florists is expected to surpass the totals from a decade ago. In 2012, the floral industry generated $5.578 million. By 2024, this amount is expected to rise to $6.43 million.

Clearly florists need their own protection, since the industry stands to lose so much revenue. An independent insurance agent can help your flower shop get set up with the proper coverage to get the job done right.

What Is Florist Insurance?

Florist insurance, sometimes called flower shop insurance, is essentially a special type of business insurance customized to protect owners of flower shops from various financial losses. Of course, only specific perils stated in the policy will be covered by the insurance company. Policies come with a list of specified non-covered perils, as well.

How to Insure a Flower Shop

The thing about flower shop coverage is that one policy won’t work for every type of flower shop, or each specific business’s owner. With the help of your independent insurance agent, you’ll work together to assemble a package of different coverages to protect yourself and your business against risks unique to you.

Flower shop insurance is designed to keep your business afloat following a huge disaster, such as property destruction or lawsuits. Since flower shop insurance is so customizable, your independent insurance agent will be sure to build a policy that fits not only your business’s needs, but also the needs of your bank account.

Who Sells Florist Insurance?

Florist insurance or flower shop insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent.

While many insurance companies could create a florist or flower shop insurance policy for you, finding coverage could also depend on the area you live in. Here are just a few of our top picks:

| Top Florist Insurance Companies | Star Ratings |

| Allstate |

|

| The Hartford |

|

| Thimble |

|

| Bolt Insurance |

|

| Hortica |

|

| Stone Creek Insurance |

|

One florist insurance company outshines its competitors:

- Best overall florist insurance company: The Hartford

We've rated The Hartford 5 out of 5 stars for their overall performance, financial strength, customer service, insurance catalogue, and more. The carrier also provides quality flower shop insurance, offering the following coverages:

Business owners policy, which includes:

- General liability insurance

- Business income insurance

- Commercial property insurance, for:

- Flowers

- Hoses

- Floral wire and tape

- Scissors and cutters

- Flower coolers

- Workers' compensation

- Errors and omissions insurance for florists

- Spoilage coverage

- Event insurance for florists

- Flower shop liquor liability insurance

With such a comprehensive coverage solution for flower shops of all kinds, The Hartford easily earns our top recommendation for florist or flower shop insurance.

What Could Go Wrong at a Flower Shop?

Flower shops are not high-risk businesses, but there are certain exposures owners need to be aware of. Florists need, not only commercial property coverage to protect their shop's building, but also plenty of liability insurance in case they get sued. Florists also need professional liability insurance in case the work they perform leads to injury or upset, such as delivering wilted flowers to someone's wedding.

Another disaster could be if the refrigeration that keeps your flowers healthy and vibrant temporarily shuts down, leading to spoilage. Or if one of your workers gets involved in a major collision while delivering flowers to a customer. A customer could also slip on a wet spot on the floor in your shop and fall and get hurt, or snag their clothing on the thorn of a rose.

What Does Florist Insurance Cover?

Flower shop insurance is set up to protect business owners against potential threats. Your policy will include the basics of business insurance coverage, with several specific coverages tailored to your unique business added on.

The more risks involved in your business, the more coverage you’ll need, but here is a handful of commonly selected coverages in flower shop insurance packages to start off:

- General liability: This coverage protects you against property damage or injury claims made by a third party.

- Workers’ compensation: If your employees become ill, get injured, or die from a work-related incident, this aspect of the insurance will cover the financial ramifications. Coverage is mandatory in most states.

- Property Insurance: Covers loss of or damage to your physical property, including your storefront and often the inventory inside it. Protected mishaps include fires, storms, and more.

- Business income: A part of property insurance, this aspect covers any financial losses suffered while a business is closed due to fire damage or other disasters.

- Spoilage coverage: This coverage is crucial for flower shop owners, because if your shop loses power due to a covered peril (e.g., lightning, etc.), your entire inventory of flowers may spoil while refrigeration units are down. Coverage takes care of replacement fees for wilted flowers in the event of a covered outage.

An independent insurance agent will ensure that you get equipped with the necessary protection to maintain smooth operations in your flower shop for many years to come.

Additional Coverages Needed by Florists

Your florist insurance package may need a few extra coverages to be complete, depending on your specific business's risk factors. Commonly added coverages to florist insurance include:

- Commercial/business auto: Provides protection for any company vehicles against things like theft, vandalism, and damage from natural disasters. If your flower shop makes home deliveries, you need this coverage.

- Sign coverage: A flower shop’s signage may be expensive to both install and replace. Signs are constantly vulnerable to the elements of nature, and thieves and vandals. This coverage provides reimbursement if you need to repair or replace your flower shop’s signage due to a covered peril.

- Cyber liability: If your business’s computer system is compromised, sensitive or personal data may be stolen and even sold to third parties. Aside from having to pay to clean up your network’s security, your flower shop could also face a lawsuit. Coverage protects against financial and legal ramifications following a cyberattack.

- Boiler & machinery coverage: Also known as “equipment breakdown” insurance, this coverage protects against “electrical injury” such as power surges or shorts that affect AC units and surge boxes.

- Glass breakage coverage: Covers the glass windowpane of your business’s storefront from things like vandalism and car crashes.

- Hired and non-owned auto liability: If your employees drive to perform company operations but you don’t have company vehicles, or if you hire outside help to perform deliveries, you might need this coverage.

Your flower shop insurance package will be assembled by selecting the coverages that work for your unique business from a big list of available options. Coverage applies to everything from lost business revenue to potential legal/court fees and beyond.

Do Flower Shop Employees Need Additional Protection?

In addition to workers' comp, you may have to get or at least consider other coverage types for your employees, for a different type of protection. Sadly, even your employees can provide threats to your customers and revenue, or sue your business. Fortunately you can purchase the following coverages:

- Employment practices liability insurance: This provides coverage for legal fees if one of your employees sues your business for sexual harassment, discrimination, or any other illegal business practice. Also protects your business if one of your employees harasses one of your customers.

- Employee dishonesty insurance: This protects your business from loss if one of your employees steals from your business or engages in other illegal behavior while on the job.

Your independent insurance agent can help you understand your business's different exposures, including potentially malicious employees, and help you find appropriate coverage to mitigate those risks.

What Doesn't Flower Shop Insurance Cover?

Though flower shop insurance covers a lot of components for business owners, it doesn’t cover just anything. The following are examples of commonly excluded perils under flower shop insurance policies:

- Routine maintenance fees

- Earthquake damage

- Nuclear reaction and war

- Power failure (unless it causes damage to computer systems)

- Robbery

- Pollution

- Temperature/humidity changes

- Inexplicably lost inventory

- Flood damage*

*In states that are prone to natural disasters and flooding, you’ll most likely want to purchase additional flood coverage for your flower shop, or you may even be required to have it by your mortgage lender. Your independent insurance agent can give you more information about finding coverage.

What Are the Benefits of Flower Shop Insurance?

Flower shop insurance provides protection to business owners in a number of ways. Beyond your physical assets and building, many components of your flower shop stand to be destroyed or otherwise harmed by common threats.

There are four major benefits to having flower shop insurance:

- Protection against legal trouble: A costly and damaging event like a fire could send a business into the red without the proper coverage. If the business became unable to pay off their loans, venders, or employees, they could face serious legal consequences. Flower shop insurance helps prevent these ugly matters from surfacing.

- Protection against a damaged reputation: Huge incidents affecting businesses of all kinds often end up in the media. When it comes to customers’ personal property getting lost, damaged or destroyed, word about their upset could spread quickly and even turn from gossip into media coverage. Having the right flower shop insurance can help prevent your business’s reputation from going up in flames.

- Protection against spoilage: Just one incident can result in an entire batch of flowers wilting right before a huge order is needed for an important event. Especially important for flower shop owners, spoilage protection can help the business recover from lost goods and inventory.

- Protection against bankruptcy: Imagine a severe storm or other terrible incident like an airplane crash that literally wipes out your flower shop’s entire storefront. Without the right insurance, the business owner could easily be forced into bankruptcy. Flower shop insurance helps businesses stay open, stay afloat, or rebuild following massive destruction.

Your independent insurance agent can help you review your flower shop insurance policy to answer any remaining questions about your coverage. They’ll also be able to help you figure out whether you’ve got enough coverage, or if you should purchase more.

How Much Does Florists Insurance Cost?

Really, it depends on a number of factors. Flower shop owners might only pay somewhere between $400 and $500 annually if they run a relatively small shop, while owners of huge flower shops in major cities with tons of business might pay closer to $1,500 or even more per year.

Of course, it’s hard to offer an average figure, since each flower shop is unique. But it all depends on several aspects of your business, like:

- The type of flower shop: This involves more than just whether the flower shop specializes in tiger lilies or petunias. The kind of equipment your flower shop uses and the specific services offered will affect its risk level to insure. Obviously, more danger means more money for flower shop insurance.

- The location of the flower shop: Larger cities tend to have higher costs for insurance, but it goes beyond that. Depending on where you are specifically, your location may be more prone to various weather-related risks. Flower shops located right on a coast may have premiums up to 20% higher due to risk of hurricane damage.

- The number of employees: The more you've got, the more workers' comp you’ll need. Simple as that.

- How much business you generate: Premiums are calculated based on business projections for the upcoming year. If your workload doubles, so will your premium, most likely.

Your independent insurance agent can work with you to find a policy that fits within your flower shop’s budget. Have your financial restrictions in mind before you start shopping for coverage to help speed the process along.

Frequently Asked Questions For Flower Shops

Florists pay an estimated $400 to $1,500 per year for $1 million in general liability coverage.

That depends on your unique business's risk factors and coverage needs. You could pay only a few hundred dollars per year, or it could be well over $1,000. A local independent insurance agent can help you determine the cost of your policy.

To answer this, you'll need the help of an independent insurance agent. The two of you will assess your flower shop's risk level by considering your property coverage needs, liability exposures, number of employees, annual revenue, and more.

If your flower shop makes deliveries or uses vehicles for any other business purposes, then yes, you'll need a commercial auto insurance policy. Business vehicle use is not covered by standard business insurance, unless commercial vehicle insurance is added.

Your flower shop needs general liability coverage, cyber liability coverage, and professional liability coverage to protect against all the various lawsuits that could stem from your customers or other third parties.

Some of the biggest risks flower shop owners face are lawsuits from upset customers, employee injuries on the job, lost revenue due to temporary closures, and losses due to spoiled flowers.

You'll need hired and non-owned auto liability insurance to protect your business against lawsuits that could arise, if you contract out your deliveries.

General liability insurance is just one aspect of the broader coverage provided by business insurance. General liability protects your business against lawsuits stemming from third-party injuries or property damage, while business insurance includes this coverage as well as property insurance, business income coverage, and more.

Yes, you should have coverage secured before you ever open your doors to the public. Customers could sue you on day one, or a natural disaster could seriously damage your business's property right at the beginning. You need to be prepared for the worst.

Not necessarily. It can be exceedingly difficult to predict absolutely every exposure your business could have. Your best bet to get the fullest picture of protection is to work with an independent insurance agent.

TrustedChoice.com Article | Reviewed by Paul Martin

©2023, Consumer Agent Portal, LLC. All rights reserved.

Statista

iii.org

https://howtostartanllc.com/business-insurance/business-insurance-for-flower-shops#:~:text=Cost%20Of%20General%20Liability%20Insurance,million%20in%20general%20liability%20coverage.