Ordinance or Law Insurance

(Because you never know when your city will pull a surprise code change.)

So far, life as a homeowner has been smooth sailing. But what happens when your city decides to pass a new ordinance, forcing you to make mandatory upgrades to your property? Having to comply with new ordinances can be stressful, not to mention extremely costly, without the proper coverage.

The good news is that many homeowners insurance policies come with at least some ordinance or law coverage built into them. Our independent insurance agents are here to help you get set up with the right homeowners insurance for your needs. But first, let’s take a closer look at ordinance coverage, how much you might need, and why.

What Is Ordinance or Law Coverage?

In a nutshell, ordinance or law coverage is an aspect of insurance that provides financial assistance if a building must be brought up to state codes. This can happen if an extreme incident damages a building, or if a city or state passes new legislature requiring mandatory upgrades in order to adhere to current codes.

New ordinances may require certain aspects of a building to be repaired or replaced, or they may require the entire building to be demolished and rebuilt from the ground up.

Local codes vary depending on where you live, and they change all the time. Mandatory changes required by new ordinances range from simple and cheap to complex and costly.

Why Would I Need Ordinance or Law Coverage?

Basically to keep you from having to pay out of pocket for mandatory upgrades to your home, or to cover repairs necessary after various incidents. Several scenarios could lead to your city calling for mandatory improvements on a home, and we’ll take a look at a few of the most common.

Ordinance or law coverage may be necessary for the following:

- New weatherproofing codes: In areas prone to windstorms, new ordinances may be passed that require upgrades to home features like storm windows/shutters or roofs. In areas prone to flooding, local ordinances may suddenly require homes to be demolished and rebuilt on elevated foundations such as stilts.

- New fire safety codes: New local codes may dictate stricter fire safety measures. This might involve simply adding features like fire extinguishers, or something more complicated like installing sprinkler systems or fire escapes.

- New handicapped compliance codes: New city legislation may require you to add handicapped- compliant features to your building such as ramps or lowered light switches.

- New plumbing or wiring codes: Changes in local ordinances may require you to update or upgrade features in your home such as the wiring or plumbing systems for safety reasons.

It’s a good idea to become familiar with the specifics of your homeowners insurance policy and how far your ordinance or law coverage extends. That way, should your city suddenly demand upgrades to your home, you’ll know if you’re covered.

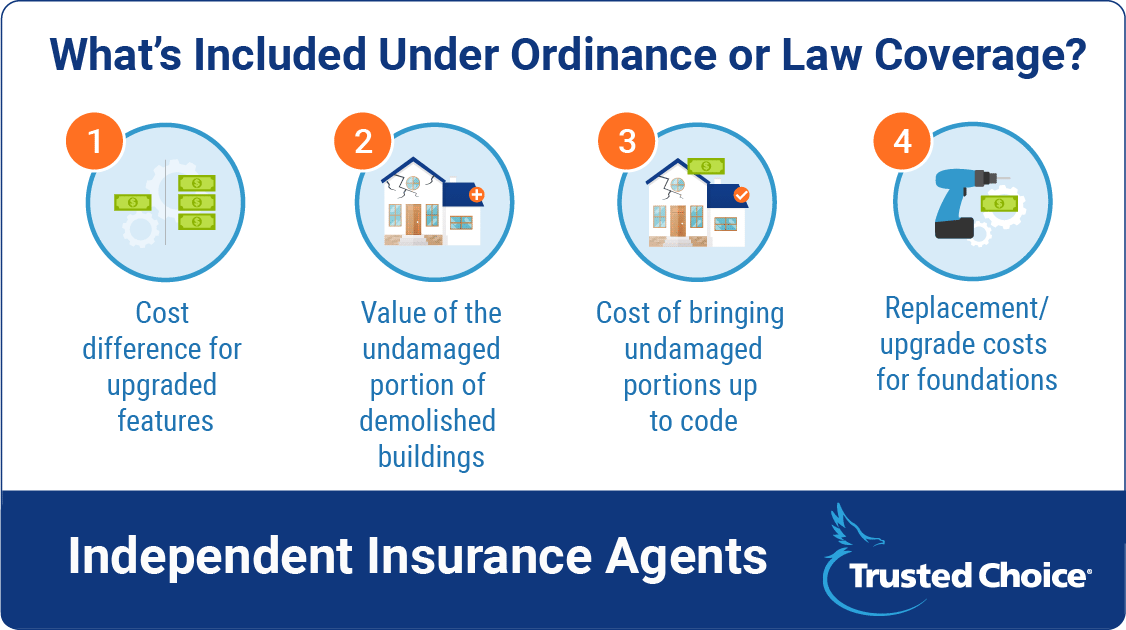

What’s Included Under Ordinance or Law Coverage?

The property coverage aspect included in standard homeowners insurance policies provides replacement values for certain things, but not nearly to the extent that ordinance or law coverage does. We’ll take a look at a few areas where homeowners policies without specific ordinance or law coverage come up short.

Ordinance or law coverage typically takes care of the following:

- The cost difference for upgraded features: A standard policy might not provide the funds to make up the difference in cost between the old feature being replaced and its upgraded counterpart. So if you’re required to install newer or fancier storm windows, standard policies will cover replacement costs equivalent to the value of your old windows, and you’ll have to pay the difference for the new ones. Ordinance or law coverage does this automatically.

- The value of the undamaged portion of demolished buildings: Let’s say a bad fire causes damage to about 60% of a building, and now the whole thing needs to be demolished and rebuilt. Without ordinance or law coverage, the undamaged 40% of that building won’t be paid for. Ordinance or law coverage also pays for the cleanup of debris or other messes left by the undamaged portion.

- The cost of bringing undamaged portions up to code: Partially damaged buildings that are required to be brought up to new codes are fully covered under ordinance or law coverage. Standard policies only provide coverage for the damaged portion.

- The replacement/upgrade costs for foundations: The foundations of buildings, including underground pipes and drains, etc., typically aren’t covered by standard policies. Ordinance or law coverage pays for replacement costs for all aspects of the building, including its foundation and related features.

Ordinance or law coverage is important to fill in the gaps left behind by standard policies lacking in full repair/replacement/upgrade protections. New local ordinances can be passed at any time, so having full coverage is worth it for peace of mind.

Does My Homeowners Insurance Policy Cover Mandatory Upgrades?

Most likely, yes. Typically, most homeowners policies have some built-in ordinance or law coverage—usually with a $10,000 limit. The thing you’ll have to consider is if this limit is high enough. You can always add more coverage to your policy, and you might especially want to if you live in an area at high risk for storms.

How Much Does Additional Ordinance or Law Coverage Cost?

Adding more ordinance or law coverage to your homeowners policy usually isn’t very expensive. Upgrading your coverage from $10,000 to $100,000 might only affect your annual premium by $50.

Considering how expensive some mandatory upgrades can get, this move might be well worth it. Have a talk with your independent insurance agent to weigh your options.

How to Find the Best Homeowners Insurance

In order to get the protection you need (and deserve), you’ll want to work with a trusted expert. Independent insurance agents will not only know where to find the best coverage and price, but also help to make sense of the fine print.

Consider your unique needs, then connect with an agent to help you take it from there. Have a list of your specific concerns and desires handy before you reach out, to help make the process even smoother.

Compare Homeowners Insurance Quotes with an Independent Insurance Agent

We all know how valuable your time is, so why spend it doing all the hard work yourself? From homeowners insurance policies to additional ordinance or law coverage, our expert independent insurance agents will help you determine what type of coverage makes the most sense for you.

Our independent insurance agents stay on top of the insurance industry and all the latest discounts so you don’t have to. That means they’ll help find the right coverage at the right price for you.

They’re not just there at the beginning, either. If disaster strikes, your agent will be there to help walk you through the claims process and make sure you are getting the benefits you’re entitled to. Now that’s thinking ahead.

TrustedChoice.com Article | Reviewed by Paul Martin

©2023, Consumer Agent Portal, LLC. All rights reserved.