Coffee Shop Insurance

Whatever the style or flavor of your coffee shop, it needs the right protection.

Like all business owners, coffee shop owners need a trusted advisor who can help them find the best insurance coverage to protect their livelihood from the many potential—and costly—problems that can arise. Whether it's dangers to the general public or your employees, or unforeseen events like fires, storms, and theft, you need the right combination of business insurance coverage that addresses whatever you might be exposed to.

Having the right coverage for your coffee shop is the key to maintaining smooth operations. All businesses come with risks (even the fun ones), so you’ll need to obtain protection during your preparation phase. An independent insurance agent will get to know you and your business. They can work with multiple reputable companies that specialize in coffee shop insurance. But first, let's talk a bit more about coffee shop insurance.

Why Do I Need Coffee Shop Insurance?

If you own and operate a coffee shop, you’ve probably spent a great deal of time and money setting up your business. You’ve had to hire employees, rent or buy equipment, purchase furnishings and décor, procure your products, and perfect your recipes. Yet so much of what can go wrong is entirely out of your control. At any time, your hard work can be jeopardized if you don’t have the right insurance coverage.

Whether you own a stand-alone coffee shop or you operate a mobile cart or kiosk, you need coffee shop insurance to protect your investment when the unexpected happens. All coffee shops tend to be fast-paced environments, and many disasters can't be predicted, from financial woes to employee injuries, accidents, and lawsuits. Whatever the size or type of coffee shop you run, it needs coffee shop insurance.

Here are just a few things that can go wrong that should be addressed with coffee shop insurance:

- A customer or supplier slips and falls in your shop.

- Guests in your shop damage furniture, bathrooms, display cases, or equipment.

- Food, beverage, or ingredients are contaminated or spoiled.

- Breakdowns of espresso machines, coffee makers, toasters, ovens, or other baking equipment.

- Fire, extreme weather, or a natural disaster.

- Theft or vandalism by customers or employees.

An independent insurance agent can further explain the importance of coffee shop insurance to you.

Who Sells Coffee Shop Insurance?

Many insurance companies sell coffee shop insurance, but a lot of them don’t advertise it by name. Most insurance companies that sell small business insurance can create a customized insurance package for you based on the needs of your coffee shop, while a few others already offer a package titled coffee shop insurance.

Still, the best way to find the right coffee shop insurance company for your needs is to work with an independent insurance agent. These agents are experienced in helping customers of all kinds, including coffee shop owners, so they know which companies to recommend. They’ll be able to offer informed suggestions based on company reliability, rates, and more.

| Best Coffee Shop Insurance Companies | Star Ratings |

| The Hartford |

|

| Progressive |

|

| Next Insurance |

|

| Bolt Insurance |

|

While a ton of insurance companies could create a coffee shop insurance policy for you, finding coverage could also depend on the area you live in. That being said, one coffee shop insurance company outshines its competitors:

- Best overall insurance company for coffee shop, cafe, and coffee house insurance: The Hartford

While the package sold by The Hartford is titled restaurant insurance, its coverage is designed to meet the needs of many food industries, including coffee shops, cafes, and coffee houses. The Hartford starts their coffee shop insurance package with a business owners policy (BOP), and then offers add-on coverages to complete the order needed for your business. A BOP includes the basic general liability protection, commercial property coverage, and business income coverage needed by coffee shops.

The Hartford also offers the following add-on coverages to their coffee shop insurance:

- Workers' compensation

- Commercial auto insurance

- Employment practices liability insurance

The Hartford has been in the insurance industry since 1810 and has been rated "A+" by A.M. Best. In addition to their impressive credentials and coverage options, customers report a high level of satisfaction in interacting with the company, including when filing claims. All these elements combined lead to The Hartford winning the title of our top pick for coffee shop insurance.

What Does Coffee Shop Insurance cover?

Every coffee shop needs a customized package of property, liability, automobile, crime, and other business insurance policies to protect them from financial losses. Talk to your independent insurance agent about the specifics of your coffee shop and your need for the following types of coffee shop insurance:

Property coverage for coffee shops

Coffee shops need business property coverage for:

- Buildings and their contents

- Inventory and stock

- Business interruptions

Your commercial property insurance offers protection for your building (if you own it), as well as everything inside it. If you sustain a property loss after a fire, a tornado, lightning, theft, vandalism, or some other covered event, this policy helps you pay to rebuild, make repairs, and replace destroyed or damaged furniture, kitchen equipment, inventory, stock like coffee cups and cutlery, and even outdoor tables, umbrellas, and lighting.

When you have a property loss, you might also have to close down for a while in order to make repairs and restock your coffee shop. In these cases, your business interruption insurance, which is usually part of a commercial property policy, helps replace lost income during the shutdown period. It also covers some of your ongoing expenses like rent, employee salaries, utility bills, and more.

Talk to your independent insurance agent about your need for equipment breakdown coverage. It protects against costs associated with the sudden and accidental breakdown of machinery and equipment. It pays to repair or replace the equipment, as well as any business interruption costs that accompany it.

Liability Insurance for Coffee Shops

Liability insurance protects your business when you are considered to be negligent or are blamed for causing harm to an individual or another business. It's your financial lifeline if you are sued by a third party.

Commercial general liability (CGL) insurance provides broad protection for third-party bodily injury and property damage claims. If a guest gets burned by coffee that is too hot, or spoiled milk in a hot cappuccino drink causes an illness, your general liability policy pays for direct costs (medical bills, etc.) as well as attorney fees, court costs, settlements, and judgments if you are sued.

CGL insurance also provides coverage for product liability, advertising liability, slander, and libel claims against your coffee shop.

Get Protection for When Food Goes Bad

Coffee shops need special coverage for product losses due to contamination or spoilage. Contamination and spoilage coverage pays for certain losses if coffee, milk, or other ingredients are spoiled or contaminated due to refrigeration breakdown, utility interruption, or some other type of foreign substance contamination.

If your local board of health or another agency forces you to close because of food contamination, your contamination and spoilage insurance may cover you for lost income during the shutdown period as well as costs related to cleaning contaminated equipment, and disposing of and replacing spoiled food.

What Are the Biggest Costs of Running a Coffee Shop?

Coffee shop owners not only have to pay for the insurance they need, but their business also comes with many costs. Here are some of the most common:

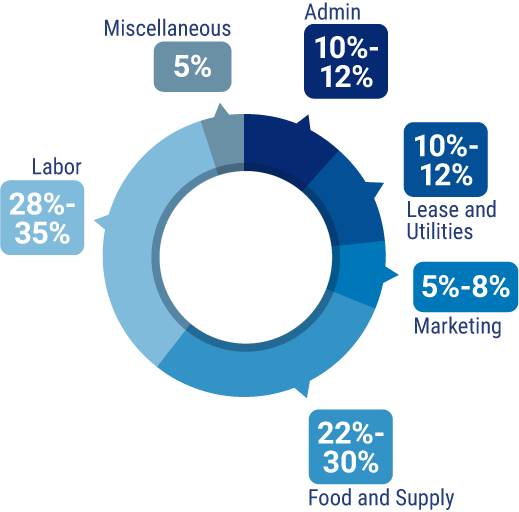

The biggest chunk of money spent on running a coffee shop falls into the labor category, at 28% to 35%. Next up are food and supply costs, coming in at 22% to 30%. Admin fees are tied with costs for leases and utilities, each falling between 10% and 12%.

Other Coffee Shop Insurance to Consider

Aside from major property and liability risks, coffee shop owners are likely to need several other insurance policies to protect them from financial harm and unexpected events. Talk to your independent insurance agent about your need for the following:

- Commercial auto insurance protects any vehicles owned by your coffee shop. In addition, if employees drive personal vehicles for business use—like picking up at bakeries or making occasional deliveries—you need hired and non-owned auto liability insurance.

- Crime coverage protects your coffee shop if an employee or a group of employees engage in theft, forgery, or fraud that damages your business. It also offers coverage in cases of shoplifting and vandalism.

- Workers’ compensation insurance is required for any business that has employees. It protects your workers, including store managers, baristas, servers, and cashiers, from the costs of work-related injuries and illnesses. This coverage pays for medical bills and lost wages for employees who sustain cuts, burns, slip-and-fall injuries, repetitive motion injuries, or any other injuries or illnesses related to their work.

- Cyber liability insurance protects your coffee shop if you are the victim of a cyber breach. If your computer network or website is hacked and confidential customer or vendor information is exposed, the damage to your reputation and bottom line can be insurmountable.

- Employment practices liability coverage protects you if a current or former employee sues you for discriminatory employment practices.

- Valuable papers coverage might be a part of your BOP already, but if not, you may want to add it to protect important paperwork that could get lost or destroyed by a covered disaster like a hurricane.

- Employee dishonesty coverage protects your coffee shop from malicious or destructive acts by your employees, such as theft, property damage, etc.

Finding Discounts and Savings on Coffee Shop Insurance

While coffee shop insurance isn’t necessarily cheap, fortunately many insurance companies offer a handful of competitive discounts and other ways to save money on coverage. An independent insurance agent is especially skilled in finding money-saving hacks for coffee shop insurance customers.

The discounts available vary greatly depending on which insurance company you go through, but here are a few examples of common discounts offered on coffee shop insurance policies.

- New/updated construction discount: Your commercial property insurance coverage could receive a premium discount if your coffee shop's building was recently built or updated.

- Safe premises discount: You could receive a discount on the liability portion of your coverage if your coffee shop provides especially safe premises to prevent customer injury.

- Annual premium discount: You could qualify for a discount on your coffee shop insurance if you opt to pay your premiums annually in one lump sum, rather than monthly installments.

- Security systems discount: Your coffee shop might qualify for discounted property coverage if your building is equipped with security measures like burglar alarms or cameras.

- Formal safety plan discount: Your workers’ comp coverage could be discounted if your coffee shop provides a formal safety plan to help avoid employee injury, sickness, and death.

- Insurance package discount: You’re likely to save quite a bit on your coffee shop insurance if you shop for a special packaged product of all the protections you need, rather than purchasing each required type of coverage separately.

An independent insurance agent can not only help you find all the coverage your coffee shop needs to maintain smooth operations, but also find the most affordable rates by browsing a number of different insurance companies’ coffee shop insurance products.

Comparing Coffee Shop Insurance Policies

When shopping for coffee shop insurance, it's handy to work with an independent insurance agent. Beyond that, you'll want to look for certain types of coverage in the policy to ensure that you're getting the best bang for your buck, and the best picture of protection for your business.

| You'll know it's the right policy for you if it covers your: |

| Business property and equipment |

| Commercial liability expenses |

| Business interruption costs |

| Extra coverages tailored to your business's niche |

| It's an even better policy if it covers: |

| Cyber liability costs |

| Commercial vehicles |

| Your workers |

Mishaps and Scenarios to Think about for Coffee Shop Insurance

When getting set up with coffee shop insurance, it’s a good idea to think about some common mishaps that could affect your business in order to prepare for them in advance. Here are just a few common mishaps and scenarios to consider when looking into purchasing coffee shop insurance:

- Your business gets damaged or destroyed by a natural disaster: If a destructive natural disaster rolls through your town and hits your coffee shop, you’ll need to make sure your commercial property insurance is adequate. While business property insurance covers many natural disasters, it typically doesn’t cover flood damage or earthquakes. You’d need a separate policy to prepare for either of those disasters, and an independent insurance agent can help you find the right coverage.

- A customer gets sick after consuming your products and sues you: Whether your coffee shop is found to be responsible for a food poisoning claim or not, you’ll need to have enough liability coverage to protect yourself either way.

- One of your employees gets into an accident with the company vehicle: If your coffee shop uses company vehicles, it’s important to get commercial auto insurance to protect them while they’re out on the road, or parked in the lot. A regular auto insurance policy will not cover vehicles used for business purposes.

- One of your employees gets injured, ill, or dies on the job: Sadly, employee injuries, illnesses, and deaths are some of the biggest threats businesses of all kinds face. That’s why it’s so important to make sure you have enough protection for your employees under a workers’ compensation policy.

An independent insurance agent can list off several more examples of common mishaps and scenarios to consider while browsing through your available coffee shop insurance options. They’ll help your business anticipate and prepare for the worst by selecting the best available coverage for your needs.

Frequently Asked Questions about Coffee Shop Insurance

The actual package of coffee shop insurance may not be legally required to run your business, but you must carry coverages such as CGL insurance to protect yourself. In the food industry, it's especially important to have liability protection in case one of your customers gets sick.

Certain mortgage lenders will also require you to carry commercial property insurance on your coffee shop's building before you can open for business. So, while a coffee shop insurance package itself is unlikely to be mandatory, the important coverages it provides often are.

To answer that, you'll have to address the needs of your specific business. It's a great idea to review your coffee shop's setup and operations with an independent insurance agent, to help ensure that you get matched to a policy that covers all of your business's risk areas.

For coffee shops with an online ordering option, having the right cyber liability coverage is even more important to protect your business in case a customer's credit card or personal info gets stolen during or after the transaction. Cyber liability insurance for coffee shops is more important today than ever, since the number of customers who place coffee orders through smartphone apps jumped up 23% in 2019.

As for curbside pickup, dine-in areas, and drive-thrus, the standard coverages provided in coffee shop insurance, like CGL, should be enough to protect you.

Truthfully, it depends. On quite a few things. A fairly busy café in a mid-size city might pay $2,800 annually in combined liability insurance, workers’ comp and more. However, a large coffeehouse in NYC that has a huge clientele will probably pay more than that.

On average, coffee shops and cafes in the US pay about $35/monthly, or about $405/year, for just the general liability insurance for their business. Purchasing coffee shop insurance as a packaged product can help save you money on getting several critical coverages together

Why Are Independent Insurance Agents Awesome?

Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, they’ll also cut the jargon and clarify the fine print, so you know exactly what you’re getting.

Independent insurance agents work for you and not one insurance provider. Actually, they’re the only agents who can check policies from multiple carriers. Plus, you’ll never outgrow an agent. They have the flexibility to find the right coverage as your business continues to expand and evolve.

TrustedChoice.com Article | Reviewed by Jeffrey Green

©2023, Consumer Agent Portal, LLC. All rights reserved.

Statista

iii.org

irmi.com